US Federal Reserve exits the Network for Greening the Financial System

When even the Federal Reserve of the U.S. is opting out of the woke climate cabal NGSF, then the central banks of poorer countries have no business participating in NGFS’s wasting of time and money. A commentary by Vijay Jayaray of the CO2 Coalition, first published at RealClearMarkets

For many across the world, the U.S. Federal Reserve’s decision to exit the Network for Greening the Financial System (NGFS) is a sign that central banks can refocus on their primary mandates: stabilizing economies, controlling inflation and fostering growth.

Developing nations that need financial backing for the development of fossil fuel projects to advance economic development hopefully can look forward to a reversal of the vacuous injection of a climate change agenda into monetary policy. This corruption of the financial system has burdened the impoverished of the Third World with “green” mandates that impede the eradication of poverty and the ills that accompany it.

Currently, NGFS membership includes central banks and financial institutions from 22 countries in Africa, 32 in Asia-Pacific and 20 in the Americas, which may now be emboldened to reevaluate – and abandon – whatever priority they have assigned to climate initiatives.

Banks and asset managers often look to central banks for guidance on regulatory priorities. The Fed’s departure may prompt others to scale back useless climate commitments, putting an end to the unnecessary diversion of resources from immediate socioeconomic challenges.

Time for Global Central Banks to Begin the Exodus

For instance, Canada’s federal government has implemented a plethora of climate policies, leading to higher carbon taxes, more volatility in the energy sector, lower export income and an overall disastrous state of the economy. Aspiring to drive Canada towards more climate idiocy is Mark Carney, recently elected Canada’s prime minister by the ruling Liberal Party.

However, other Canadians have different thoughts. “Major banks across North America are leaving Mark Carney’s international net-zero banking scheme, but some Canadian banks remain members, says Rebecca Schulz, Alberta Minister of Environment and Protected Areas. “The remaining Canadian banks must abandon Carney’s net-zero banking alliance and invest in safe, affordable, reliable Canadian energy again.”

Global South has No Time to Waste

Even global entities that act as a financial bridge for development projects – like the World Bank, African Development Bank and Asian Development Bank – are deeply entrenched in the climate politics that deny billions of people potential access to affordable fossil fuels.

NGFS membership comes with expectations to adopt costly climate-related financial regulations. In the Global South, where millions still lack access to electricity or clean water, such priorities are utterly disconnected from reality.

More than 40% of the African populations – 600 million people – lack access to electricity. That translates to 20% of households with extreme food shortages and 30% of children suffering from acute malnutrition. Every day, 2 in 10,000 succumb to famine.

Nearly 4 million across the world – roughly the population of Los Angeles – die prematurely each year due to a lack of clean cooking fuels like natural gas. Many could be saved if financial institutions removed the red tape smothering investments in production of fossil fuels.

Hyperinflation, currency instability and unemployment are immediate threats that demand urgent attention in developing nations. Redirecting resources toward these issues would go much further in improving living standards than the obsession with wind turbines and solar panels to prevent a fabricated climate crisis.

When even the Federal Reserve of the U.S. – the biggest funder of the United Nations and World Bank – is opting out of a woke climate cabal, then the central banks of poorer countries have no business participating in NGFS’s wasting of time and money.

The developing world must seize this opportunity to advocate for their financial autonomy. Central banks in poorer nations should choose to prioritize the well-being of their populations and ensure that global financial governance reflects economic realities that demand an end to coercive climate policies.

This commentary was first published at RealClearMarkets on March 12, 2025.

more news

25 Years of Climate Data Show No Increase in Weather Disasters

In this article, Dr. Matthew Wielicki examines official disaster data from the past 25 years, which show no increase in global extreme weather events despite rising CO₂ levels and record temperatures. The analysis explores what the climate data reveal and why they challenge prevailing climate narratives.

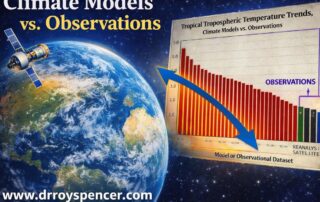

Climate Models vs Observations: Tropical Troposphere Trends 1979–2025

Climatologist Roy W. Spencer, PhD examines tropical tropospheric temperature trends (1979–2025) and finds a persistent gap between climate model projections and observations from satellites and radiosondes. His analysis raises questions about climate sensitivity and model reliability.

The Berlin Blackout and the Fragility of Germany’s Energy Transition

This article is the English translation of an analysis originally published in the German newsletter of Professor Fritz Vahrenholt. It examines how the Berlin blackout exposes structural weaknesses in Germany’s energy transition.